The sec of the treasury basically ordered the owner of Boa to buy Mery L, they said it was like Walmart buying Tiffanies..

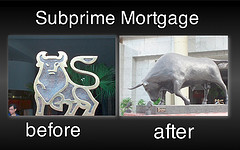

Bank of America’s Takeover of Merrill Lynch

Bank of America agreed to pay $2.43 billion to settle a class-action lawsuit with investors who owned or bought its shares when the bank purchased Merrill Lynch in 2008.  Bank of America acquired Merrill Lynch in late 2008 during the financial crisis. The $50 billion deal came as Merrill Lynch was within days of collapse, effectively rescuing it from bankruptcy. This settlement ended a three-year fight with a group of five plaintiffs, including the State Teachers Retirement System of Ohio and the Teacher Retirement System of Texas. They accused the bank and its officers of making false or misleading statements about the health of Bank of America and Merrill Lynch and were planning to seek $20 billion if the case went to trial. Bank of America denied these allegations and agreed to pay the settlement as a way of eliminating extended litigation.

Bank of America acquired Merrill Lynch in late 2008 during the financial crisis. The $50 billion deal came as Merrill Lynch was within days of collapse, effectively rescuing it from bankruptcy. This settlement ended a three-year fight with a group of five plaintiffs, including the State Teachers Retirement System of Ohio and the Teacher Retirement System of Texas. They accused the bank and its officers of making false or misleading statements about the health of Bank of America and Merrill Lynch and were planning to seek $20 billion if the case went to trial. Bank of America denied these allegations and agreed to pay the settlement as a way of eliminating extended litigation.

The Players:

- Bank of America: Bank of America Corporation is a bank holding and financial holding company. Its primary headquarters are located in Charlotte, North Carolina. Brian Moynihan is the current CEO, while Charles Holliday serves as chairman. Bank of America operates in 32 states, the District of Columbia, and more than 30 countries internationally. Bank of America functions through the “banks” in which they provide a variety of banking and non-banking financial services and products. As per 2011 financials, the shareholder’s equity was $232.50 billion.

- Ken Lewis: In 2008, when Bank of America took over, Ken Lewis was Merrill Lynch’s chairman and CEO.

- Merrill Lynch & Co.: Merrill Lynch was founded in 1914; it quickly became successful, specializing particularly in investment banking. The company continued to build its brokerage network and eventually became known as the “Thundering Herd.”

- John Thain: He was chairman and CEO of Merrill Lynch and was in this position for about nine months when he made this weekend deal with Bank of America.

- The Securities and Exchange Commission (SEC): The SEC is a federal agency that acts as the primary enforcer of federal securities laws and regulates the securities industry, the nation’s stock exchanges, and other electronic securities markets in the United States. The SEC has the authority to bring civil enforcement actions against individuals or companies alleged to have violated the securities law.

- Government and Economy of the United States of America: From the government’s point of view, another major collapse of a Wall Street corporation would likely cause an enormous crisis in an already unstable financial climate. The overall economy of the United States was at risk; there were fears that a deep depression could result in untold damage to the citizens of the country. Even without total economic collapse, the taxpayers were certainly at risk in taking on the financial obligations of a failed Merrill Lynch.

Comments

Post a Comment